From Porter Stansberry in Stansberry Digest:

Hell hath no fury like a newsletter subscriber’s derision…

Some of you, dear subscribers, will no doubt remember the warnings I (Porter) wrote about in late April predicting that the markets would turn over in May.

Specifically, in the April 29 Digest, I wrote: “I believe the panic will start in May. In fact, I believe for decades to come, the summer of 2016 will be recalled as the beginning of the end… a period of grand financial catastrophe.”

Well, it seems like a lot of subscribers don’t think anything bad enough has happened yet. As subscriber Marty G. told us in an e-mail…

Has to be said… Porter is “crushing it” with his big predictions the last several years [sarcasm]. The latest being that May 2016 would bring a significant decline in the stock market. S&P was close to a 6 month high instead. When does he plan to resign? He would surely be fired anywhere else. I’m finished embarrassing myself by forwarding his big announcements on to other non-subscribers.

(What do you think? Should I be fired? I’d love to hear your perspective. Send your thoughts to feedback@stansberryresearch.com.)

Here are my thoughts about the matter…

Nobody is going to call the top of this market to the day or even the week. If I’m right within several months, that’s still doing investors a terrific service. And frankly, I think it’s way, way too early to say that my call – that the bear market would resume in May and intensify over the summer – is wrong.

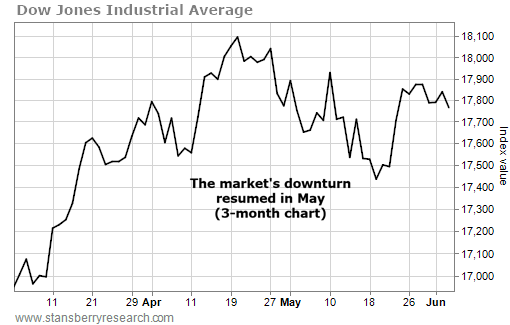

In fact, so far, just looking at the market, a reasonable person would conclude that I might be right. After peaking above 18,000 in late April, the Dow has fallen below 17,500 and hasn’t broken out of a downtrend yet. The market is down big again today as I write. But regardless, a lot more is happening just below the surface of the market that I believe investors should really be watching right now…

In my April warning, I told you to look for a few signs…

I want you to keep your eye on commercial real estate – as tracked by the Vanguard REIT Fund (VNQ)… the automobile industry – as tracked by General Motors (GM)… and the U.S. retail sector – as tracked by the SPDR S&P Retail Fund (XRT).

Maybe you haven’t noticed, but GM’s sales are down 18% year over year. What’s the problem? The company is running out of ways to get subprime borrowers credit as auto losses are beginning to scare off lenders.

Jamie Dimon, CEO of JPMorgan, explained at a recent investment conference in New York: “Someone is going to get hurt [in auto lending]… We don’t do much of that.”

In May, total outstanding auto loans cracked $1 trillion for the first time ever. Sooner or later, someone is actually going to have to repay these loans. GM’s shares are down about 10% since their late April high. Another sign that consumers have simply run out of credit: The amount of buyers leasing new cars (instead of buying them) is hitting new all-time highs (31% of all new vehicle sales).

Now, just ask yourself… if banks don’t want to make new car loans because of rising defaults and too many subprime borrowers… how are the auto companies going to avoid big losses on these aggressive new leases?

And how are things going in commercial real estate? I told you to track the amount of empty mall space…

Think about the amount of empty mall space. It’s great that Amazon’s (AMZN) earnings are soaring, but what that also means is malls are dying. Sooner or later, all of this empty commercial space will begin to hurt commercial real estate in general. Those malls are going to end up as office complexes and apartments… something nobody has figured out yet.

My “favorite” (that’s sarcasm) mall REIT is called WP Glimcher (WPG).

Simon Property Group (SPG) – the biggest mall owner in America – spun off all of its worst malls. At first, it called this spinoff “Washington Prime,” which was a great piece of marketing. Most real estate investors know that Washington D.C. real estate almost never declines in price – thus, a REIT consisting of “prime” Washington real estate would likely trade at a big premium.

Unfortunately, the business had nothing to do with Washington real estate at all. The name was just putting “lipstick on a pig.” But it worked. Simon got the worst of its assets off its books. (Too bad for investors. The shares are down about 50% since the spinoff.)

It’s now called Glimcher because of a recent acquisition. And the stock had rallied strongly off the late January lows, from around $7 all the way to $11. But in May, that upturn reversed and the stock is back down about 10%. Simon, the “big dog” in the mall business, was also down about 5% in May.

And retail? I guess nobody remembers that retail was absolutely destroyed in May when the sector released pitiful earnings. Macy’s (M) fell 15% in one trading day on May 16 when it reported its fifth straight quarterly revenue decline. Kohl’s (KSS) fell 9% on its worst quarterly report since 2009.

Even the sector’s stalwart, Nordstrom (JWN), fell 13% in one day after it reported its profits fell to $0.26 per share, from $0.66 a year earlier, a decline of more than 60%. Following that day’s decline, the stock was down 21% for 2016… and almost 50% over the past year…

Finally, since I wrote that April warning, nothing has emerged from the world’s financial markets that makes me change my mind. Instead, the data continue to get worse…

It’s not just that the U.S. economy is obviously stalling in the face of a stronger dollar (as Friday’s jobs number seems to indicate). It’s the corporate sales and earnings picture that really spooks me.

When I wrote my April warning, only about half of the S&P 500 had reported first-quarter earnings. Today, virtually all of the data is in. And it’s not good: In this year’s first quarter, the S&P 500 recorded an average annual decline of more than 7% in corporate earnings. This marks the fourth straight quarter of annual-earnings declines for America’s biggest and best companies. Given that interest rates can’t fall further, it’s hard to imagine that the stock market can do well in the face of declining earnings.

Beyond the market, declining earnings are an important warning about something worse. For the last 115 years – as far back as we have reliable records – two consecutive quarters of falling U.S. corporate earnings have led to a recession 81% of the time.

The other major harbinger developing is the rising default rate in the corporate-bond market. The speculative-grade default rate has reached 4.1%, its highest level since 2010. Ratings agency Standard & Poor’s downgraded another 64 companies in May with total debts of about $151 billion. Thus, the downgrade-to-upgrade ratio (which really helps to describe the availability of credit in corporate America) is currently 2.3-to-1. Last year, that ratio finished at 2.1-to-1. (It was 1-to-1 in 2014 and 0.89-to-1 in 2013.)

Think of this ratio as how much the “spigot” is open for additional credit in corporate America. If credit quality is deteriorating, it doesn’t matter how much lower rates go. Big increases to lending aren’t going to happen.

I’ve been telling folks that this massive credit cycle – the huge boom in the corporate-bond market that begin in 2011 – is winding down. We’re approaching a period of vast credit defaults and massive corporate restructuring. The data continue to support my view… and these problems will be ugly for stock market investors, as common equity holders are generally wiped out when companies default on their bonds.

So while I don’t think I have anything to apologize for (at least, not yet), whether my warning turns out to be right or wrong… I do think it’s important that someone speaks up when things in the market really don’t look right. And more so than at any other time in my career, that time is right now.

You see, in addition to the “normal” problems of the credit cycle, declining profits, and an aging bull market, our entire financial system is currently sitting on top of a house of cards.

According to the most recent tally (by ratings agency Fitch), the total amount of sovereign debt now charging negative interest rates is in excess of $10 trillion, up about 5% since April. Negative interest rates are a sign of a completely broken global financial system. In the event of a real market panic, with investors fleeing stocks, bonds, and paper currencies, how will central banks restore calm and order? By promising to charge even higher rates of negative interest?

I’m hardly the only experienced market hand who sees something important happening. Bill Gross – the best, most experienced fixed-income asset manager of the current generation – put it this way in a letter he published last week…

For over 40 years, asset returns and alpha generation from penthouse investment managers have been materially aided by declines in interest rates, trade globalization, and an enormous expansion of credit – that is debt. Those trends are coming to an end.

Please be careful.

Oh… one more thing… how are my market warnings reflected in our recommendations? Well, since the start of this year, my research group and I have seen 20 of our current recommendations increase in value by more than double digits –including multiple bond recommendations. (We’ve left a few names off the list that are still trading under their buy-up-to prices out of fairness to subscribers.)

(Nothing is more rewarding than making bigger-than-stock-market gains in bonds. In this situation, you’re taking far less risk than stock investors, and making even bigger returns!)

Below, you’ll find a sample of the gains seen in these positions across my publications so far this year…

We’ve succeeded because of our macro view. We’ve focused on investments that should do well during a period of financial turmoil (like gold stocks). Other examples include Ritchie Bros. Auctioneers (RBA) and the PIMCO 25+ Year Zero Coupon Fund (ZROZ) – situations in which value creation occurs because of financial turmoil. Likewise, we’ve looked for situations like Fannie Mae (FNMA) and Freddie Mac (FMCC), where the odds of substantial value creation are completely uncorrelated to the markets as a whole.

The results are some of the best of my career for a five-month period and occurred despite (or even because of) these difficult market conditions. So… what’s your verdict? Should I be fired? Let me know at feedback@stansberryresearch.com.

By the way… you may have noticed that the rally in precious metals resumed Friday. Gold was up 2.5%, but gold stocks – as tracked by the VanEck Vectors Gold Miners Fund (GDX) – led the way, up more than 10%.

This is classic bull market action… But it’s just a preview of what’s to come. In a gold bull market, gold stocks as a group can rally hundreds of percent… And certain gold stocks will soar 10… 20… or even 50 times in price.

This is why we launched Stansberry Gold Investor a few months ago… and why I put my own name on a gold-research product for the first time in my career. As longtime readers know, when I decide to do something, I make sure it’s great… and I wanted my subscribers to have access to the best gold and precious metals research available anywhere.

I believe we’ve done just that… All 15 of our recommendations to date are showing gains – including 13 double-digit winners – in less than two months.

If you’d like to join us, it’s not too late… Including this week’s brand-new recommendation – which we revealed last Tuesday night during a special, live, subscribers-only call – we currently have four recommendations in buy range. But Friday’s rally tells me that probably won’t be the case for long. Click here to learn more about Stansberry Gold Investor. (No long video)

Regards,

Porter Stansberry